eKYC SolutionsSeamless VerificationIn today's fast-paced world, customers expect swift access to services. With our eKYC solutions, businesses can ensure a seamless remote onboarding experience that not only meets security and regulatory standards but also provides a smooth and fast user experience. AML Screening

AML Screening Face Match

Face Match Liveness Detection

Liveness Detection ID Document Verification

ID Document Verification

Our Solutions:

AML Screening

AML Screening Face Match

Face Match Liveness Detection

Liveness Detection ID Document Verification

ID Document Verification

Where is eKYC for Customer Onboarding needed

Whether for age verification or complex due diligence, our eKYC solutions ensure accuracy across multiple industries

Age-Restricted Products|Bank Account Opening|Sharing Economy Services|Wallets and Exchanges

How Does eKYC for Customer Onboarding Work?

Our streamlined process minimizes friction for users during onboarding, creating a flawless user journey from start to finish:

01

Upload Documents

Customers simply upload a picture of their document for verification.

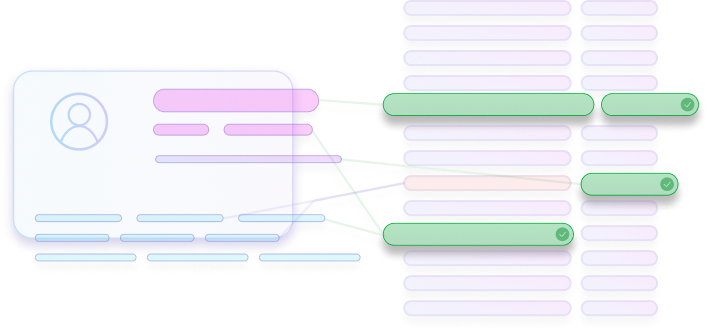

02

AI comparison

Our AI instantly matches and verifies customer details against submitted documents.

03

Quick results

Verification is completed within seconds, offering users a hassle-free experience.

Client Onboarding & eKYC Process - Fully Tailored

With Uney, you can customize your eKYC workflow. Adjust identity verification steps based on your specific needs.

ID Document Verification

Supports over 7,000+ document types from 220+ countries.

Face Matching

Ensures identity verification with a photo comparison.

Liveness Detection

Adds another layer of fraud prevention by confirming users are 'live.'

AML Screening

Ensures high-risk clients undergo rigorous due diligence and sanction checks.

Advantages of eKYC

In today's rapidly evolving world, customers demand fast service access. Our eKYC solutions enable businesses to guarantee a seamless remote onboarding process that not only adheres to security and compliance standards but also delivers a quick and convenient user experience.

Learn More

Real support from real people. We’re available through instant live chat and email to help you set up and troubleshoot.